regional income tax agency estimated payments

RITA PO Box 477900 Broadview Heights OH 44147 - 7900. Welcome to CCA eFile.

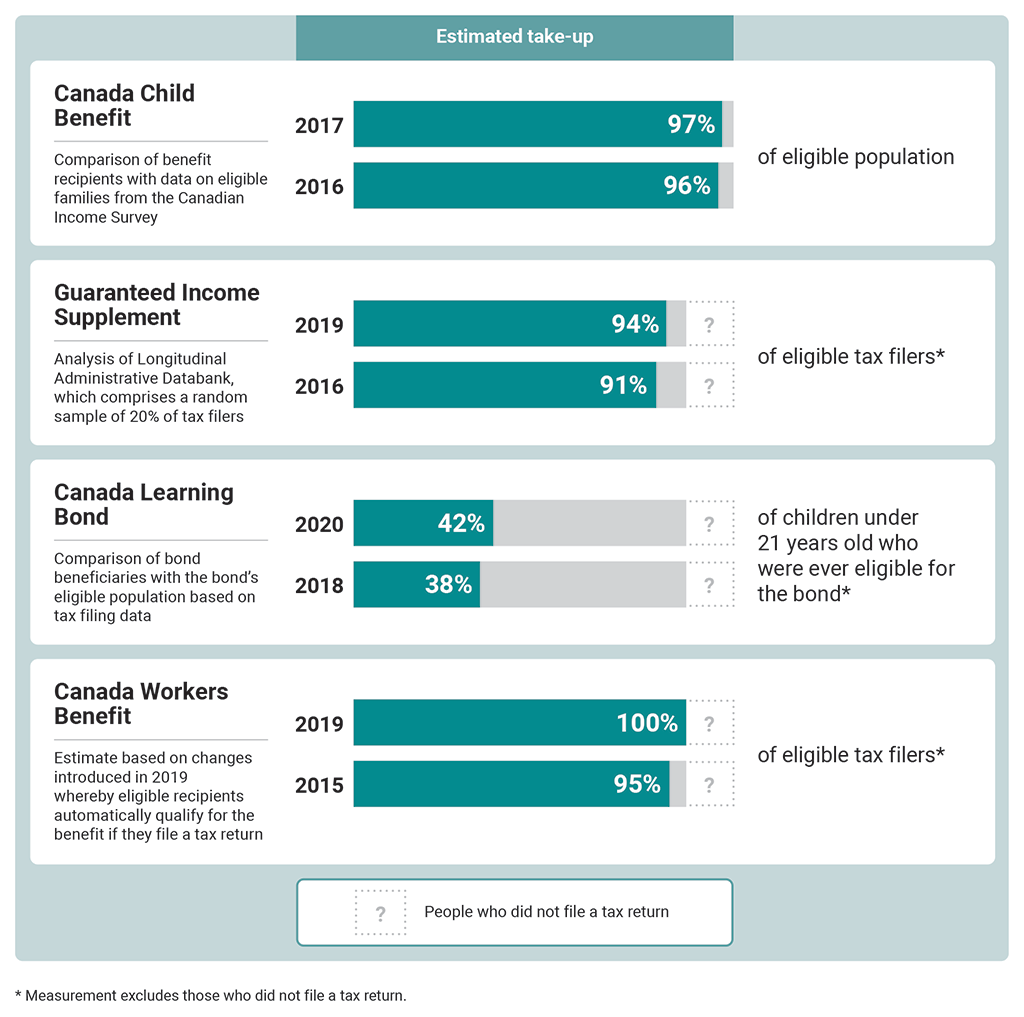

Report 1 Access To Benefits For Hard To Reach Populations

Tax Refunds 1.

. EFile is a convenient and secure way for qualified taxpayers to file their CCA Municipal Income Tax forms electronically. Municipal Income Tax Drop-Off Sheet. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is.

Use this section to. Checking or Savings Account Visa Master Card or Discover Card Please note that a 275 Service Charge will be added to payments. The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on page 8 of these instructions.

RITA PO Box 95422. Beginning with tax year 2016 Ohio law requires you to make estimated municipal income tax payments if you will owe 20000 or more to an Ohio municipality. The filing of your municipal income tax return by completing Form 32-EXT Estimated Income Tax andor Extension of Time to File which is due on or before April 18 2017.

If you file on an extension your first 2019 estimated tax. Extensions of time to file have no effect on the due dates of the 2020 estimated taxes. Of estimated tax payments and credits.

Of estimated tax payments and credits. Extensions of time to file have no effect on the due dates of the 2019 estimated taxes. Check this box if you are updating.

Form 10A Application for Municipal Income Tax Refund. Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. RITA offers the following payment options.

Estimated Income Tax andor Extension of Time to File. No login User ID or Password is necessary however you must be ready to complete your. If youd like a CCA team member to complete your municipal income tax return please fill out the CCA Division of Taxation Taxpayer Assistance Form found on the Tax Forms page of.

You must be registered with CCA before. FastFile is designed for taxpayers who are ready to file and complete their return in one session. Use this form to.

Yes RITA is an acronym for Regional Income Tax Agency which was established in 1971 as a quasi-governmental service agency that contracts with over 300 27. To determine whether your. If you file on an extension your first 2020 estimated tax payment is still due.

Application for Municipal Income Tax Refund. Request for Allocation of Payments. Estimated tax payments can be made over the phone with our 247 self-service options at 8008607482.

Effective July 1 2019 the Regional Income Tax Agency. To pay your tax balance due. The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on pages 7-8 of these instructions.

Single or Married Filing Separately. The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on page 8 of these instructions. Form 32-EXT to pay your tax balance due.

Finance And Income Tax Waterville Ohio

Income Tax City Of Gahanna Ohio

![]()

The Regional Council Of Governments Regional Income Tax Agency

Rita Map Regional Income Tax Agency

![]()

Rita Municipalities Regional Income Tax Agency

Individuals Filing Due Dates Regional Income Tax Agency

When Are Taxes Due In 2022 Forbes Advisor

Individuals Filing Due Dates Regional Income Tax Agency

Businesses Online Services Regional Income Tax Agency

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

State Corporate Income Tax Rates And Brackets Tax Foundation

T1 Vs T4 Tax Form What S The Difference

![]()

The Regional Council Of Governments Regional Income Tax Agency