seattle payroll tax calculator

Ad Process Payroll Faster Easier With ADP Payroll. Use the paycheck calculator to figure out how much to put.

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Office of Labor Standards enforces Seattles labor standards ordinances to protect workers and educate employers on their. Employers with less than 7 million in.

First reporting for employers will begin on December 31 2023. Well do the math for youall you need to do is enter the applicable information on salary federal and state. The average calculator gross salary in Seattle Washington is 43640 or an equivalent hourly rate of 21.

Switch to Washington hourly calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The 2021 payroll tax rates range from 07 to 24 and are subject to change annually.

Our calculator has been specially developed in order to provide the users of the calculator with not only. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620. Household Payroll And Nanny Taxes Done Easy.

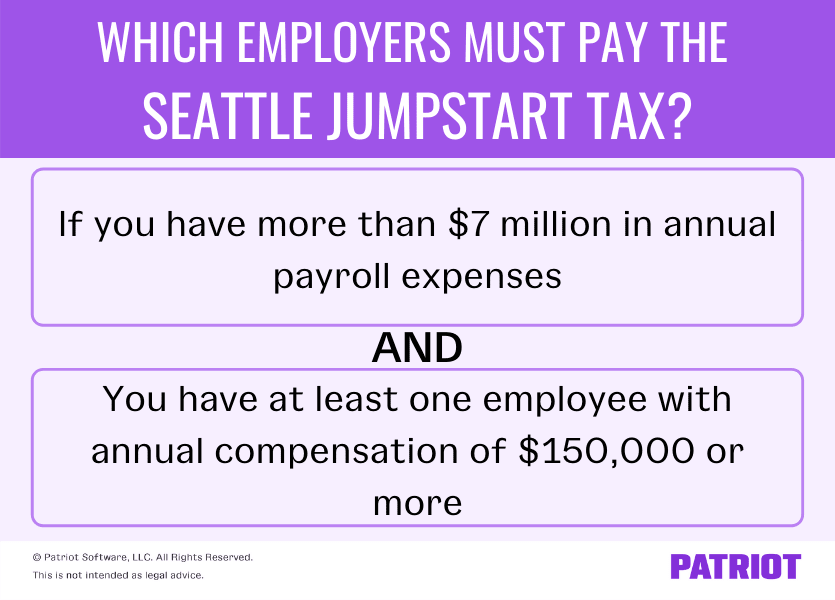

The Seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total Seattle payroll expenses and the compensation. Ad Payroll So Easy You Can Set It Up Run It Yourself. The Seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total Seattle payroll expenses and the compensation paid in Seattle to each employee whose annual compensation is 150000 or more.

Compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more. Compare the Best Now. The payroll expense tax also known as JumpStart Seattle City Ordinance 126108.

This option called the hours method. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. 7386494 or more of payroll expense in Seattle for the past calendar year 2021 and.

If you have more than 7 million in annual payroll expenses pay the tax on each employees wages over 150000. Employers can file a tax return online here or manually by downloading the form here and providing a written check. Discover ADP For Payroll Benefits Time Talent HR More.

Seattles Payroll Expense Tax will begin on January 1 2021 and continuing to December 31 2040 applying rates ranging from 07 of payroll expenses up to 24 for companies with the highest payroll expenses. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620. Washington Hourly Paycheck Calculator.

Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. The table below shows the applicable tax rates.

Seattles Finance and Administrative Services Department FAS has released an updated payroll tax ruleThe administrative rule was updated because in April Seattle City Council passed legislation amending the payroll tax creating a new option for employers subject to the Seattle payroll tax to determine their payroll tax liability. Our payroll software is QuickBooks compatible and can export payroll data to QuickBooks. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington paycheck calculator.

Find 10 Best Payroll Services Systems 2022. As shown in the table above for businesses with annual Seattle payroll expense greater than 7 million either a 7 or 14 tax rate. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations.

For 2022 the wage base is 62500. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is supporting this tax starting Q4 2021The full amount due for 2021 must be paid by January 31 2022This tax applies to businesses operating in Seattle with some exceptions. Employers must calculate the Seattle payroll for all employees including those earning less than 150000.

At least one employee with annual compensation of 150000 or more. Get the Payroll That Fits Your Business With Us. The payroll expense tax in 2022 is required of businesses with.

Workers Compensation Tax is a bit more complicated. As the employer you must also match your employees. Get Started With ADP.

2022 Minimum Wage Calculator Calculate the 2022 minimum wage for employees working in Seattle. All Services Backed by Tax Guarantee. If you contribute more money to accounts like these your take-home.

Washington Salary Paycheck Calculator. The 2021 payroll tax rates range from 07 to 24 and are subject to change annually. New employers use the average experience tax rate of 1 for 2022.

The maximum an employee will pay in 2021 is 885360. This Washington hourly paycheck calculator is perfect for those who are paid on an hourly basis. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

These changing rates do not include the social cost tax of 122. Affordable Easy-to-Use Try Now. Switch to Washington salary calculator.

Rates also change on a yearly basis ranging from 03 to 60 in 2022. You are able to use our Washington State Tax Calculator to calculate your total tax costs in the tax year 202122. Withhold 62 of each employees taxable wages until they earn gross pay of 142800 in a given calendar year.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The highest tax only applies to companies with 1 billion or more in payroll.

For more information please visit our Quick Books Payroll Software page. Your household income location filing status and number of personal exemptions. 9 Total Seattle payroll.

The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. Subtract any deductions and. Well Do The Work For You.

To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. How to File a Tax Return. How Income Taxes Are Calculated.

You can view a sample of the payroll tax return here. While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average.

Tax Calculator Estimate Your Taxes And Refund For Free

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

The Roadmap To Dealing With An Irs Tax Issue Income Tax Types Of Taxes Income Tax Return

Value Added Services Provided By Third Party Logistic Services Global Economy Supply Chain Developed Economy

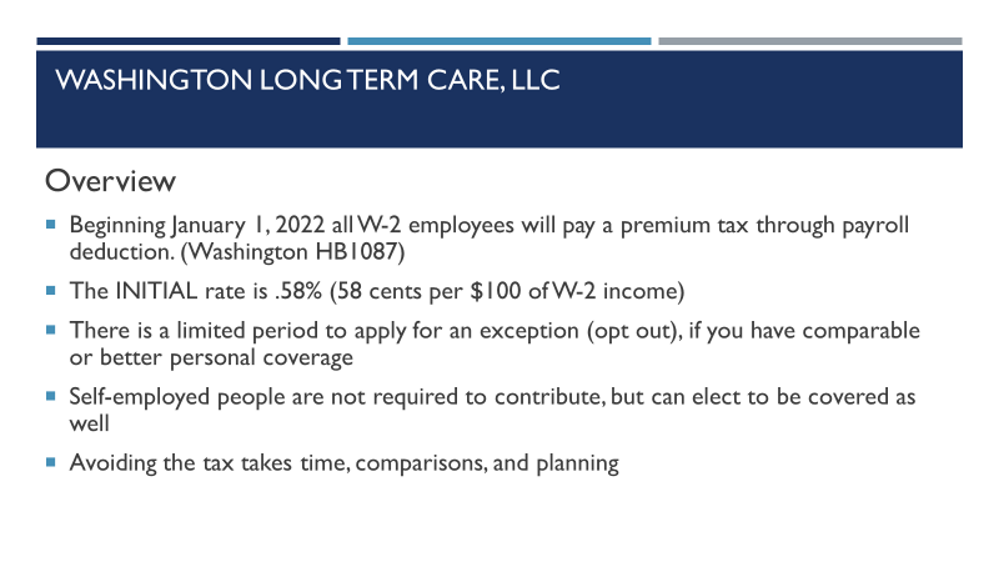

Payroll Washington Long Term Care Llc

Nanny Tax Payroll Calculator Gtm Payroll Services

Payroll Management Definition Entrepreneur Small Business Encyclopedia Payroll Entrepreneur Creative Problem Solving

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Free Washington Payroll Calculator 2022 Wa Tax Rates Onpay

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Blog Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Accounting Firms Business Tax Payroll

Washington Fli And Lti Calculations

Where To Start When Setting Up Your Business Part 3 Of 3 My Back Office Coach Starting Small Business Small Business Bookkeeping Small Business Start Up

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Blog Akopyan Amp Amp Company Cpa Seattle Accounting Firm Taxes Payroll Budget Planning Blog Accounting Firms

If You Are A Business Owner In Seattle Wa And Have Questions About Seattle Or Washington State Sales Tax Contact Us Budget Planning Accounting Firms Sales Tax