car lease tax write off reddit

If you finance your car then you can write off your own car payments. With a lease the deductions would be spread out over the term of the lease.

Section 179 Tax Deduction Explained Alpharetta Ga Near Sandy Springs Cumming Gwinnett Duluth

Car on paper is worth 125K after 3 years.

. Gross vehicle weight can qualify for at least a partial Section 179 deduction plus bonus depreciation. The business deduction is three-quarters of your actual costs or 6000 8000 075. So if you have a 50000 car with 100 business use 50000 divided by five years is a 10000 tax write-off every year.

For example lets say you spent 20000 on a new car for your business in June 2021. When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. You can only depreciate the first 30K it might be 32K.

Yes you can deduct the capitalized cost reduction tax too. 30 per year 12 of 30 in the first year. Either or but not both.

For 2011 taxes the car is in the third year of its lease. You are buying the car through a business and have legitimate enough business use for the vehicle. However my tax guy mentioned since I own a Scorp that If I lease a car through my Scorp it would be a 100 write off.

The cost of the gas that you use to get there would be considered a deductible expense. I am slightly intrigued. The lease payment is 400 per month or 4800 per year.

And you must itemize in order to take the deduction. Option A Lease a 50K car for 3 years and write off payments of 30K. What you can write off with the actual expenses method.

If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes. Using Appendix A the applicable inclusion amount is 122. Eligible operating cost deductions include vehicle registration insurance and licensing fees gas oil changes and other routine.

If you bought it a few years ago you can even write off a portion of the cars original cost. I am considering leasing a car that is a little more lavish than my current car and is all electric Tesla S. If you pay 30000 for the vehicle you may be able to deduct that entire 30000 in the year of purchase.

With interest and the standard depreciation I have around a 2600 write off this year. Buy -- depends largely on how much you plan to drive and the type of car you want. Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year.

There are two methods for figuring car expenses. Business use of the car is 70 percent. The deduction is based on the portion of mileage used for business.

Which plan works better for you -- and whether or not to lease vs. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes. Car lease 100 write off for S-corp.

Because in that case with a lease youre still paying 4800year writing off 2400 but with owning youre paying 0month but still writing off maybe 600 or so maintenance aside. You can either take a deduction based on the business miles driven at the standard rate this year it is 575 centsmile or you can take a deduction of your actual costs of the vehicle including lease payments based on the percentage of total miles driven for business if you use it 60 for business you can deduct 60 of costs. The so-called SALT deduction has been around for a while and it allows eligible taxpayers to deduct certain state and local taxes such as property tax and income tax or sales tax.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Option B Buy a 50K car. On top of that if theres an upfront cost or.

Car Lease Tax Write Off. If you lease a new vehicle for 400 a month and you use it 50 of the time for business you may deduct a total of 2400 200 x 12 months. The lease payments will be 1075 per month Which is a 12900 per year payment at 95 usage is a 12255 write off.

If a taxpayer uses the car for both business and personal purposes the expenses must be split. These expenses replace the mileage-based deduction you take with the standard mileage method. Therefore the income tax deduction is 327460 calculated as 4800 - 122 x 70.

Leased Vehicle Write-Offs. Lease payments and vehicle maintenance of a car leased through a sole proprietor are tax-deductible in the same manner if you opt to deduct the cost of actual operating expenses. Look at Section 179 deductions.

More simply you can take a. Deducting sales tax on a car lease. Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs.

The deduction limit in 2021 is 1050000. The deduction is based on the portion of mileage used for business. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in.

You must choose either sales tax or income taxes to deduct. They quoted me a rate of 8 for reference I was approved for 2 through my bank. The list of vehicles that can get a Section 179 Tax Write-Off include.

Thats usually 36 or 48 months. Or do you mind only writing off a couple hundred dollars a year 5 or 6 years from now but have a paid off car. You can choose between deducting your actual expenses which include your lease payments auto insurance fuel maintenance repairs tires and other operating expenses or taking the standard mileage deduction which was 545 cents per mile for business miles for the 2018 tax year.

Once your lease period ends you have the option of returning the vehicle to the dealer or purchasing it at a pre-determined amount which is defined in the lease. With interest and the standard depreciation I have around a 2600 write off this year. They also only accept up to 2000 for a down pagment.

Then you sell the car after 3 years for 25K. He said I had to at least make 4 payments through their finance company before refinancing. So I normally do not buy a car new and definitely have not considered a lease.

Jul 31st 2009 545 pm. You can add parking fees and tolls to either method. Thats because that travel time is considered to be outside of your normal commuting time However the only caveat for getting a gas tax write off is that you can only deduct this expense if you are self-employed.

If you pay 30000 for the vehicle you may be able to deduct that entire 30000 in the year of purchase.

Is It Better To Lease A Car In 2021 Usa R Personalfinance

Blue Model 3 Tesla Models Car Automotive Cars Autos Tesla Model Tesla Electric Car Tesla

The Benefits Of Getting Preapproved For A Car Loan Credit Karma

How Does This Work Is This Actually Possible R Tax

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

4 Things To Know Before You Donate A Car Credit Karma

Uber And Lyft Infographic From Uber Diva Infographics Infographic Ecommerce Infographic Social Media Infographic

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Tesla Model 3 Reveal Tesla Tesla Model Model

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

2020 Audi R8 Decennium Carporn Audi Sports Car Audi R8 Used Audi

1988 Lamborghini Countach 5000 S Lamborghini Lamborghini Lamborghini Automobil

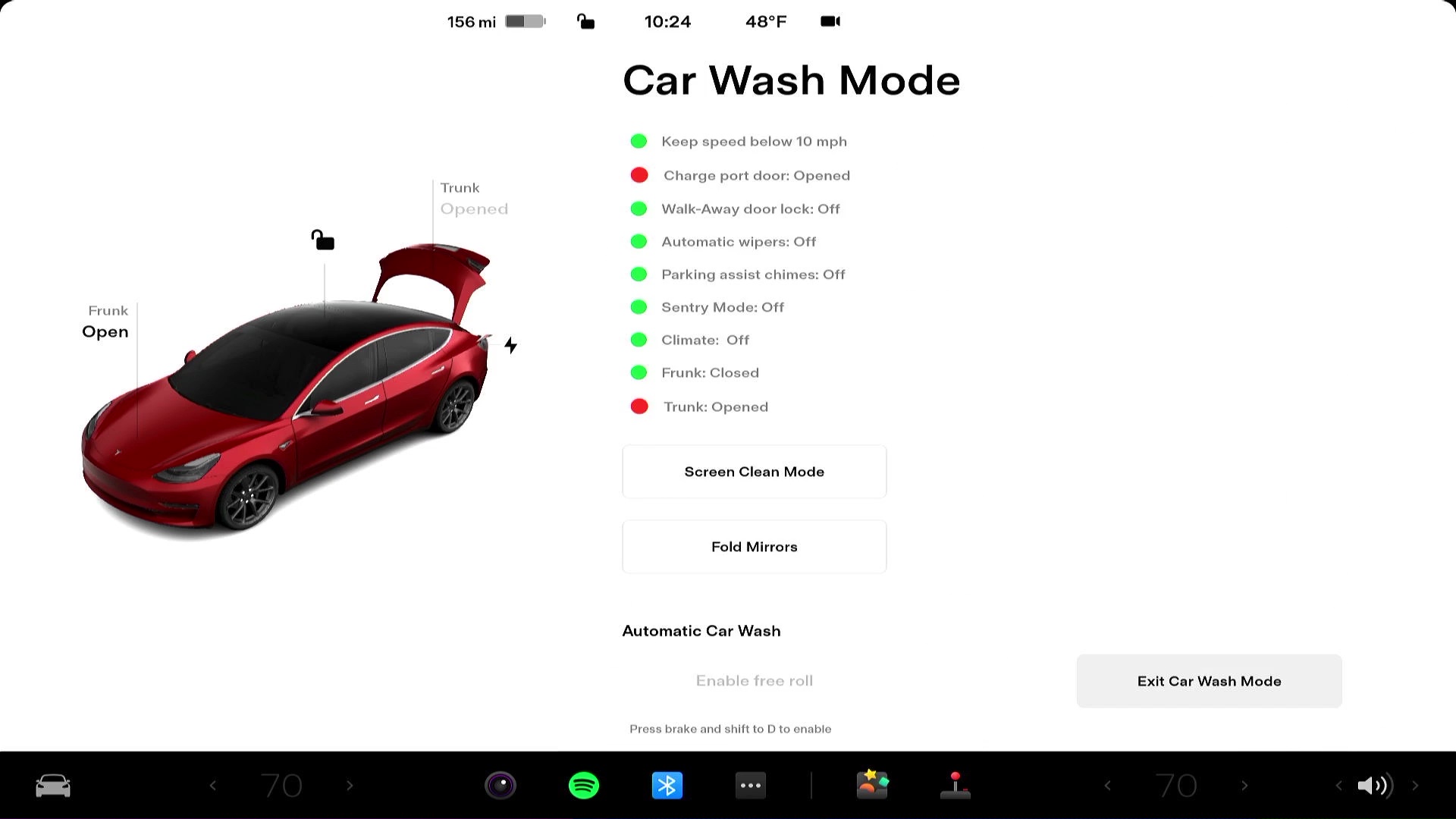

Writing Off Luxury Vehicles Like A Tax Professional

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Dont Buy From Shift Or Carvana R Askcarsales